[주간투자동향] MGRV attracts KRW 12.5 billion in Series B bridge investment

[ad_1]

[주간투자동향] MGRV attracts KRW 12.5 billion in Series B bridge investment

This is the start-up era. The domestic startup craze that started in 2010 has grown rapidly over the past 10 years. Korea has established itself as the 5th largest startup powerhouse in the world, having produced 11 unicorn companies. Competitive start-ups such as Coupang, Woowa Brothers, Yanolja, and Blue Hall have penetrated our real lives, and even now, numerous start-ups dreaming of success are taking on challenges in fierce competition. In response, IT Dong-A is the site of these domestic startups. [주간투자동향]summarized and provided.

MGRV attracts KRW 12.5 billion in Series B bridge investment

MGRV, which operates Co-living house ‘Mangrove’, a community-based residential service, attracts KRW 12.5 billion in Series B bridge investment and completes the Series B investment with a total of KRW 27.5 billion. did. This investment was led by TS Investment, and HB Investment, ES Investor, Seoju Ventures, Simone Asset Management, and Shinhan Asset Management participated. The cumulative amount of investment attracted is KRW 32.5 billion.

Co-living refers to a form of shared housing that separates an independent personal residential space and a common space for work, rest, and hobbies. It is a new type of housing equipped with facilities and services tailored to single-person households. MGRV operates a community-based co-living house brand, Mangrove. Starting with ‘Mangrove Sungin’ in 2020, ‘Mangrove New Establishment’ and ‘Mangrove Dongdaemun’ are being operated, and ‘Mangrove Sinchon’ is scheduled to open on February 17, 2023. The annual vacancy rate of Mangrove is around 5%, and sales in 2022 increased by about 5 times compared to the previous year.

Based on this investment attraction, MGRV plans to develop a dedicated app and PMS (Property Management System) for building a shared housing platform, and expand new businesses in the field of senior co-living and work. Based on space planning and development capabilities, we plan to make efforts to advance mangrove services.

MGRV CEO Cho Kang-tae said, “Based on this investment, we will establish ourselves as a co-living company that leads the residential experience in the era of 10 million single-person households. We plan to respond with economies of scale in the domestic co-living industry by expanding our business to various regions including Seoul.”

Superblock attracts KRW 9 billion Series A investment

Superblock, a blockchain mainnet start-up, has attracted a series A investment of 9 billion won. SK Corporation, Netmarble Corporation, DSC Investment, E& Investment, and Schmidt participated in this investment.

zoom inSource: Superblock

zoom inSource: SuperblockSuperblock is a blockchain mainnet developer. It is a platform that handles various digital assets created on the blockchain based on its own technology called Ethanos. Ethanos is a technology announced by CEO Kim Jae-yoon in his thesis ‘Ethanos: Efficient Bootstrapping for Full Nodes on Account-based Blockchain’, and the key is to technically reduce the unnecessary capacity of blockchain data.

Superblock does not develop technologies such as sidechains that support mainnets such as Bitcoin or Ethereum, but directly develops mainnets. We are developing a mainnet ‘Over Network’ with lightweight nodes that can be operated by ordinary users. In addition, we are trying to create a blockchain ecosystem that can be used easily and comfortably by launching products such as user-friendly wallets, scans, and bridges.

Superblock CEO Kim Jae-yoon said, “Blockchain technology is getting closer to real life as guidelines for token securities (STO) come out. Network security becomes more important as more people use blockchain. We plan to provide a more secure network environment based on lightweight node technology,” he said. “Superblock’s mainnet has low infrastructure maintenance costs. Therefore, it will be very advantageous to support the issuance and distribution of token securities.”

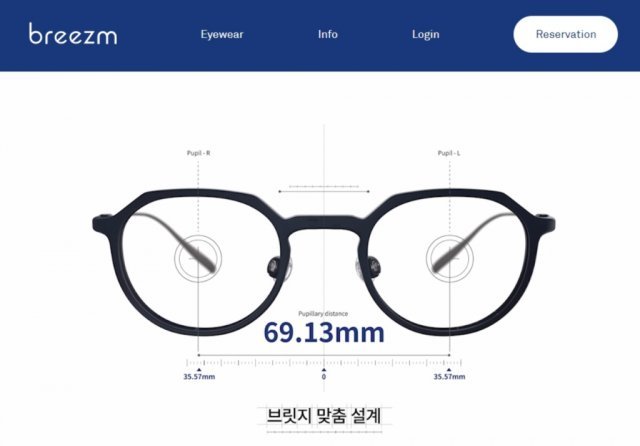

BRism attracts KRW 5.4 billion in Series A investment

BRism attracted 5.4 billion won in Series A investment. This investment was led by Seoul National University Technology Holdings, an existing investment company, and Korea Development Bank and Translink Investment newly participated. The accumulated investment attraction amount is 10 billion won.

zoom inSource: Brism homepage

zoom inSource: Brism homepageBRism uses technologies such as 3D printing, 3D scanning, and artificial intelligence style recommendation to produce personalized glasses. Since its establishment in 2017, it has provided 1:1 personal consulting by connecting professional opticians and customers through a 100% reservation system. In December 2022, it opened Magok and Sinsa stores, and is operating a total of 8 stores in the Seoul and Gyeonggi regions.

Through this investment, Brism plans to expand its customer target to the growing youth and presbyopia population, and launch related new products within the first half of the year. To this end, HP 5200 3D printers were introduced to expand production facilities in preparation for increased demand. In particular, based on the experience of running a pop-up store in New York earlier this year, they plan to open an antenna store in the second half of the year to target the US market.

Hyungjin Park, CEO of Brism, said, “The size of the domestic eyewear industry is about 2.7 trillion won, and the global market size is 183 trillion won. However, there are many users who experience discomfort due to the unified size,” he said. “Brism provides customized glasses with 3D data that scans the user’s face. Based on these technologies, we will expand the consumer base and pioneer the personalized glasses market overseas.”

Outfit Lab attracts 300 million won in seed investment

Outfit Lab, which operates the men’s fashion styling platform ‘Style Recipe’, has attracted 300 million won in seed investment. Hanyang University Technology Holdings and IPS Ventures participated in this investment.

zoom inSource: Outfit Lab

zoom inSource: Outfit LabStyle Recipe provides fashion solutions that combine fashion styling services with customer body shape/preference data. About 20,000 people are using the ‘Weekly Styling’ service, which was introduced in October 2022 and delivers styling content for free every week by analyzing body types and tastes.

Incumbent stylists with more than 4 years of experience are participating in the style recipe. Experts in charge of styling famous celebrities suggest styles that suit the user. Through this investment, Outfit Lab plans to strengthen its personalized recommendation content and recruit talent to expand its service.

Kang Chan-hyeok, CEO of Outfit Lab, said, “Men’s body shapes and tastes have diversified. In line with this, we will build a fashion platform that provides individually tailored content to users,” he said.

EOStudio attracts pre-series A investment

EO Studio (hereafter EO) has attracted pre-series A investment. This investment was led by Base Investment, and Primer Company, CNT Tech, and Nest Company participated. In addition, domestic and foreign start-up entrepreneurs and mentors joined as angel investors. The size of the investment is undisclosed.

zoom inSource: EOStudio YouTube channel

zoom inSource: EOStudio YouTube channelEO, which was established in 2020, produces video contents with startup themes. It provides entrepreneurship education service ‘EO School’ and writing platform ‘EO Planet’ for entrepreneurs, and is developing businesses such as job fairs and demo day live events. EO plans to use the investment attraction funds for global business expansion and content production.

EO started overseas expansion in the second half of 2022. It has secured 40,000 overseas subscribers through the content of Silicon Valley figures such as Michael Seibel of Y-Combinator, a global startup accelerator, and Phil Levin, founder of Evernote. Currently, 92% of all traffic comes from overseas, with the most popular countries being the US and India.

EO CEO Kim Tae-yong said, “I hope that anyone in the world can solve problems around the world and create value through their talents and businesses.” I want to prove that I can do it.”

Rabbit and Toad attracts initial investment from Mashup Angels

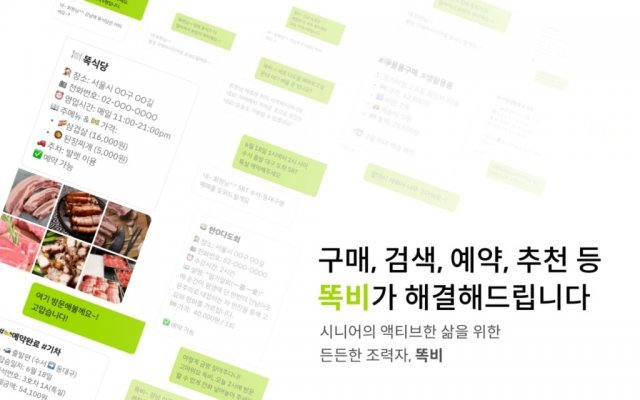

Rabbit and Toad, which operates Dokbi, a personal assistant service for seniors, has attracted initial investment from Mashup Angels.

zoom inSource: Rabbit and Toad

zoom inSource: Rabbit and ToadDokbi is a daily customized secretary service for seniors, providing services to seniors who find it difficult to use online services. When seniors request necessary parts of daily life through chatting through the Dokbi app, various online services such as information search, purchase of the lowest price items, grocery shopping, train reservations, and restaurant and product recommendations are provided. It also supports schedule management, search and payment history management, and reservation ticket confirmation.

Dokbi’s characteristic is to provide services based on interactive communication. It helps to solve online service usage procedures such as membership registration, identity verification, payment registration, and consumption activities necessary for daily life through a conversational method.

Ham Dong-soo, CEO of Rabbit and Toad, said, “Based on this investment, our goal is to secure 100,000 seniors by expanding our service.

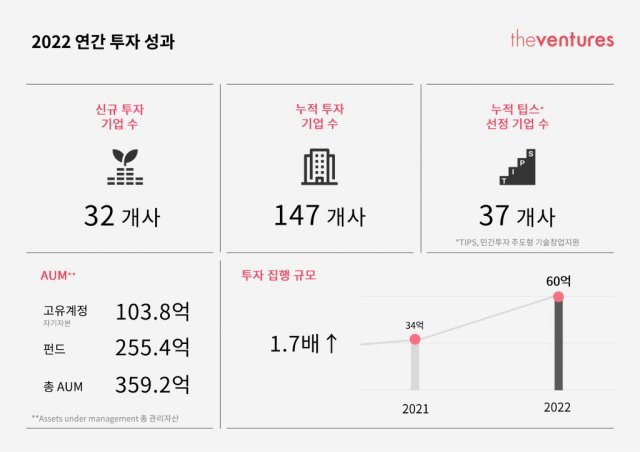

The Ventures announces last year’s investment results

The Ventures announced its annual investment performance for 2022. Since its launch as an accelerator in 2014, The Ventures has focused on initial investments in Korea and Southeast Asia. As of December 2022, a total of 147 startups were invested, and a total of 37 teams were selected for the TIPS program.

zoom in2022 The Ventures Investment Performance Infographic, Source: The Ventures

zoom in2022 The Ventures Investment Performance Infographic, Source: The VenturesThe total fund size managed by The Ventures in 2022 is 35.92 billion won. New investments were made in 32 companies, including the companies in which it invested annually, and the total investment execution amounted to KRW 6 billion, an increase of 1.7 times compared to the previous year. It grew into a venture capital after obtaining permission from the Ministry of SMEs and Startups as a start-up investment company. With this opportunity, it gained momentum in creating new funds, and in November 2022, ‘The Ventures Founders Community Fund 1’ was created. The Ventures plans to invest 100 million to 300 million won in 7 to 8 companies every month, with the goal of investing in more than 200 companies during the fund operation period.

The Ventures launched ‘TheVentures’, a community app for founders to exchange information and communicate. In addition, ‘The Ventures Online Sprint’, which enables early or preliminary startup teams to verify the market online, was introduced, and ‘Open Referral’, a startup recommendation program, was introduced.

Cheol-woo Kim, CEO of The Ventures, said, “Investors can provide various programs, but forming a community where founders can share information and know-how can resolve practical concerns or reduce the probability of failure.” In 2020, we will focus on finding good founders and startup teams, and we will work hard to revitalize a healthy startup community.”

Kim Gi-sa Lab Recruitment for Startup Investment Placement Program

Startup accelerator Kisa Kim Lab is recruiting for the ‘5th Kisa Lab’, a placement program that supports investment for the growth of startups. The 5th startups finally selected by Kisa Kim Lab through this program are ‘investment of up to KRW 300 million or more’, ‘individual mentoring for founder Kisa Kim for 3 months’, ‘special lectures for successful entrepreneurs at home and abroad and networking with related industry experts’, ‘private demo day for investors’ ‘, ‘Tips Program’, and ‘Providing Subsequent Investment Attraction Opportunities’.

zoom inSource: Kim Gisa Lab

zoom inSource: Kim Gisa LabStart-ups within 3 years of incorporation can apply without restrictions on fields. Applications for participation are due February 21st. The final selection will be announced on March 8th.

Accelerator Kim Ki-sa Lab, founded by co-founder Kim Ki-sa, has invested in a total of 50 startups from 2019 to the present, and as a TIPS operator, selects TIPS programs for startup teams and provides follow-up investment attraction.

Donga.com IT expert Kwon Myeong-gwan reporter [email protected]

[ad_2]

Original Source Link