Starting from August, the first phase of overseas income requiring electronic invoices will be implemented.

[ad_1]

(Kuala Lumpur News on the 16th) Starting from August 1, all income received from overseas in Malaysia must issue electronic invoices as proof of income for tax filing purposes.

All merchants with an annual turnover of more than 100 million ringgit must take the lead in implementing electronic invoices on August 1. The second phase is for merchants with an annual turnover of 25 million to 100 million ringgit. They will implement electronic invoices from January 1 next year. It will be fully implemented from July 1st.

Tax expert Datuk Kong Linglong pointed out when questioned that overseas income is also called overseas income, which means income that is not generated locally.

He gave examples of renting a house overseas to foreigners and collecting rent from abroad; making online purchases and sending goods to people abroad to earn income; or receiving orders from abroad, etc. Belongs to overseas income.

“For example, if you have dividends in a foreign country, or you have franchise rights or royalties in a foreign country, these are all overseas income.”

He said that there will be no double tax on overseas income. If tax is paid overseas, the Malaysian Inland Revenue Department will provide a rebate (Double Tax Deduction) if there is evidence.

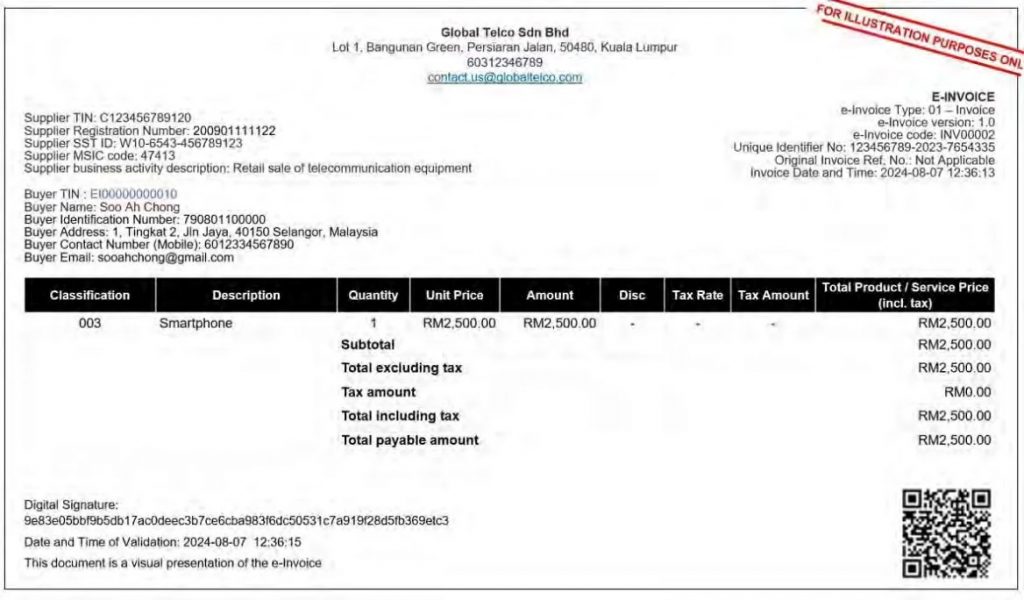

Detailed information on the payer of the electronic invoice

According to the “Special Guidelines for Electronic Invoices 2.1” issued by the Inland Revenue Board, after collecting overseas income in Malaysia, electronic invoices must be issued by the end of the next month at the latest.

The information required for electronic invoices is the payer’s name, which can be a company name or an individual’s name (if the person is a non-Chinese citizen, the name must be the same as the name on the passport, MyPR, MyKAS), tax identification number (TIN), ID card number ( Passport, MyPR, MyKAS number), address, contact number, Sales and Service Tax (SST) number.

If the payer does not have a TIN, you can enter “EI00000000020” for the electronic invoice. If you do not have an ID card number and SST number, enter “NA”.

Since the overseas payer does not use the MyInvois system, after the Inland Revenue Board verifies the electronic invoice, it will only issue a notice to the party receiving the overseas income, who will then share an electronic invoice with the overseas payer, just like a normal business record practice.

If there are any errors in the electronic invoice, the overseas payer is not in the MyInvois system and cannot request the invoice to be returned. Therefore, the Malaysian recipient can issue a credit invoice, a debit note or a refund note to correct the error.

Overseas purchasers issue their own invoices

At the same time, for purchases of goods or services from foreign sellers, the procedure for issuing electronic invoices is the same as for collecting overseas income.

Currently, foreign sellers will issue invoices, bills or receipts to Malaysian buyers as a record of the transaction, which includes information on the goods or services sold.

Do not force foreign sellers to implement

However, when my country implements the electronic invoice system, foreign sellers will not be forced to issue electronic invoices. Instead, Malaysian buyers will issue electronic invoices to record the transaction for tax reporting purposes.

The Inland Revenue Board released the “Special Guidelines for Electronic Invoices 2.1” and “Guidelines for Electronic Invoices 2.3” on April 6 to allow the public to better understand the situation after the implementation of electronic invoices.

7Specific transactions require individual invoices

On the other hand, the new guidelines issued by the tax bureau clarify that individual electronic invoices must be issued for seven specific transactions, so that the bureau can more fully grasp the information of buyers and sellers, thereby helping to reduce tax evasion and more effectively combat the shadow economy.

These specific transactions are the automotive industry, aviation industry, luxury goods and jewellery, construction industry, wholesalers and retailers of building materials, licensed bookmakers and bookmakers, payments to agents, dealers or distributors.

In an interview with this newspaper, Datuk Cai Siu Yuan, Director of Taxation and Financial Consulting of Asia Business Center, said that in the above-mentioned transactions, merchants must issue electronic invoices to each buyer, and they are not allowed to use consolidated e-Invoices at all. ).

He believes the IRB imposed this rule because these transactions are the most vulnerable to tax evasion.

Luxury jewelry temporarily exempted

However, according to the latest guidance issued by the tax bureau on April 6, due to the temporary suspension of luxury goods tax, luxury goods and jewelry are temporarily exempted, and electronic invoices or combined electronic invoices can still be used at this stage.

“When merchants issue electronic invoices, they need the buyer’s information, and after the tax bureau obtains the invoice information, it will also know how to track the buyer, so that the buyer will not easily evade taxes.

“For luxury goods and jewelry merchants, if buyers do not request electronic invoices, they can use consolidated invoices until further notice.”

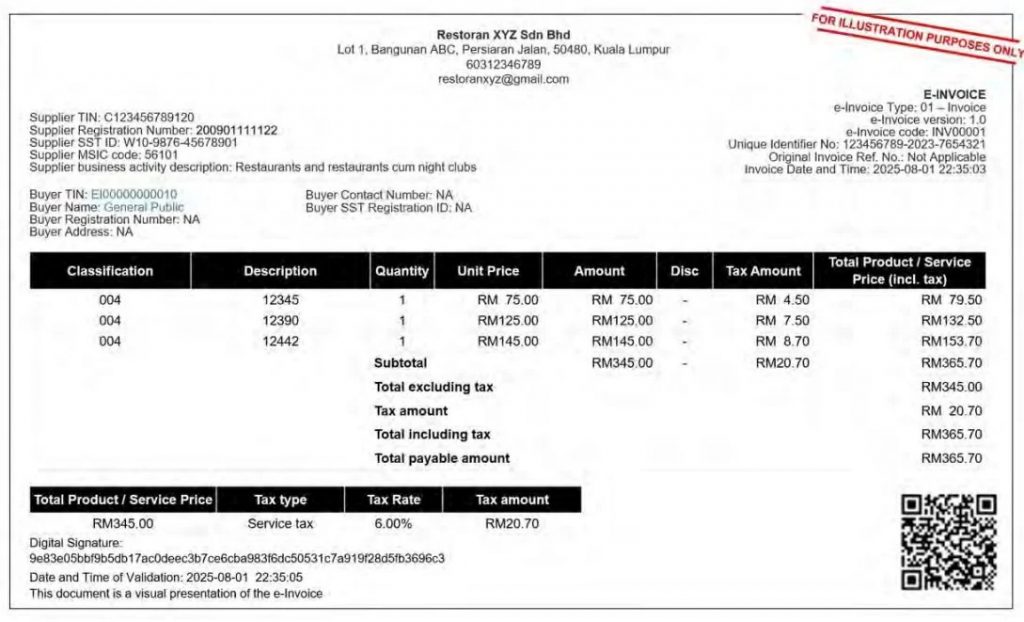

Business-to-customer retailers allow consolidated invoicing

Cai Zhaoyuan said that under the electronic invoice system, the tax bureau allows retailers with a “business-to-customer” (B2C) sales model to use consolidated electronic invoices.

“Some retailers continue to issue original invoices until the end of the month. They can combine an electronic invoice and send it to the tax bureau for verification. This information will also be entered into the tax bureau’s database and the total revenue of the merchant for a month can be known.”

He emphasized that if retailers face customers’ demands for electronic invoices, they must issue electronic invoices to customers.

The revised scholarship requires electronic invoices

The tax bureau issued guidelines on electronic invoices on February 9 and April 6 this year, and made slight modifications in the two guidelines. The latest guidelines have removed scholarships from “no electronic invoice types”.

This also means that if any organization provides scholarships to recipients, it must also submit it to the tax bureau in the form of electronic invoices.

In addition to scholarships, other types of income and expenses that do not require electronic invoices are still retained.

The following types of income or expenses do not require electronic invoices (including self-issued electronic invoices):

(a) Employment income

(b) Pension

(c) Alimony

(d) Dividend distribution under certain circumstances

(e) Islamic charity (zakat)

Individual electronic invoices must be issued for 7 specific transactions, and invoices cannot be combined. The details are as follows:

1. Transportation, including tractors

2. Aviation, such as air tickets and private charter flights

3. Luxury goods and jewelry (details are still to be announced. If the customer does not request an invoice, the merchant can issue a combined electronic invoice until further notice)

4. Construction field, such as construction contracts

5. Building materials (retail and wholesale)

6. Legal betting and gambling activities distribute bonuses to winners (wins in casinos and gaming machines are exempt from issuing electronic invoices until further notice)

7. Payment to individual agents, dealers and distributors

[ad_2]

Original Source Link